WTIUSD

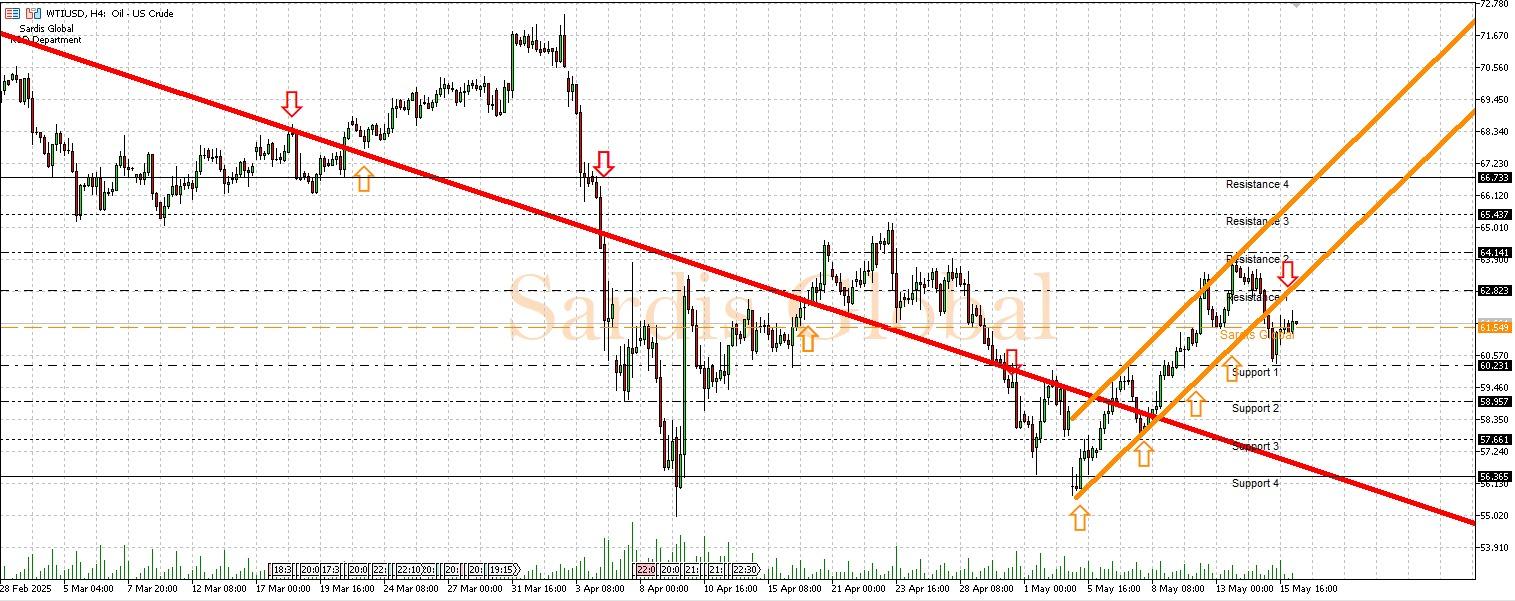

Crude oil is trading close to the pivot level of 61.549. While OPEC+'s ongoing decisions regarding production increases and geopolitical tensions in the Middle East raise concerns on the supply side, signals of a global economic slowdown and weak demand data from China are putting pressure on prices. The expected increase in fuel demand with the approach of the summer season may provide short-term support, but the technical outlook is negative. Technically, resistance levels are at 62.823, 64.141, and 65.437 in upward movements, while support levels are at 60.231, 58.957, and 57.661 in downward movements. U.S. crude oil inventories, global demand projections, and fluctuations in the dollar index should be closely monitored.

Support :

Resistance :