XAUUSD

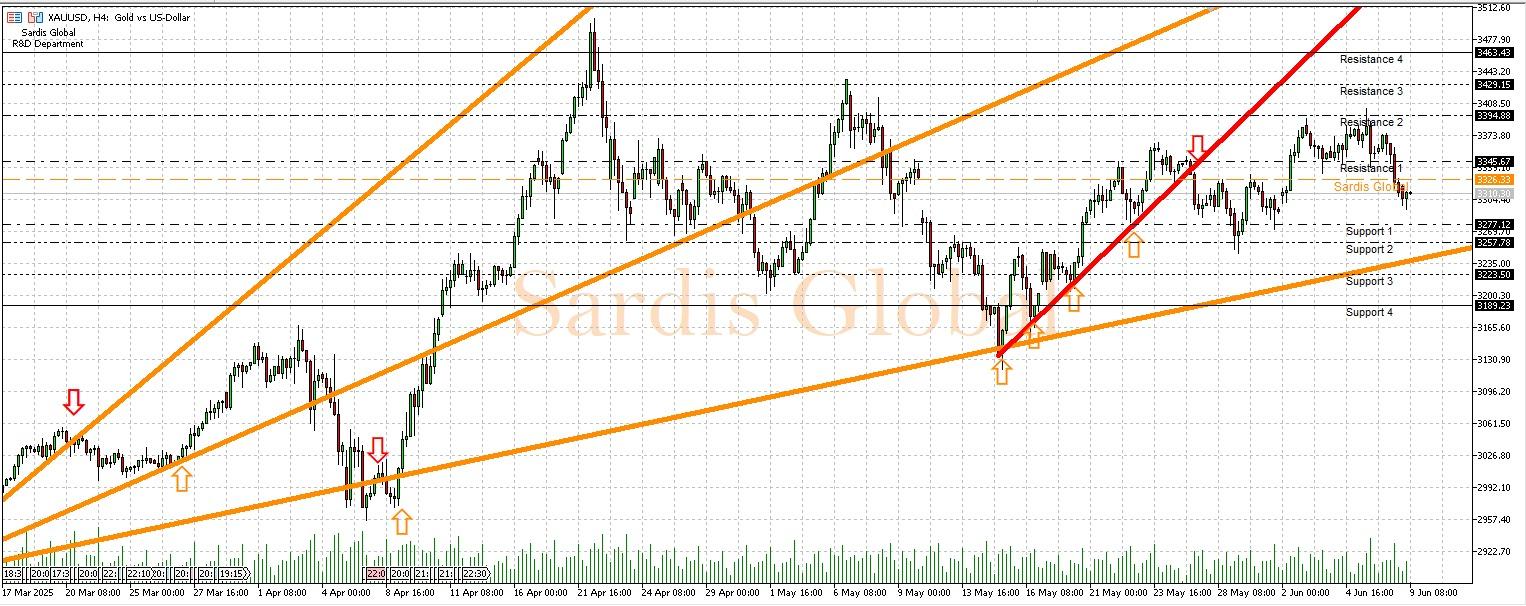

The markets for gold will focus on the US CPI data to be released on Wednesday. A stronger-than-expected inflation figure would mean that the Fed will maintain its hawkish stance, which could increase pressure on gold by raising the dollar and bond yields. In such a scenario, a pullback could occur, staying below the pivot level of 3326.33 and heading towards the supports at 3277.12 (S1) and 3257.78 (S2). However, if a cooling in inflation is expected or more pronounced, it could lead to buying in precious metals. In this case, the resistance levels of 3345.67 (R1) and 3394.88 (R2) would become important targets. Thursday's PPI and Unemployment Claims will also affect gold prices for the rest of the week.

Support :

Resistance :