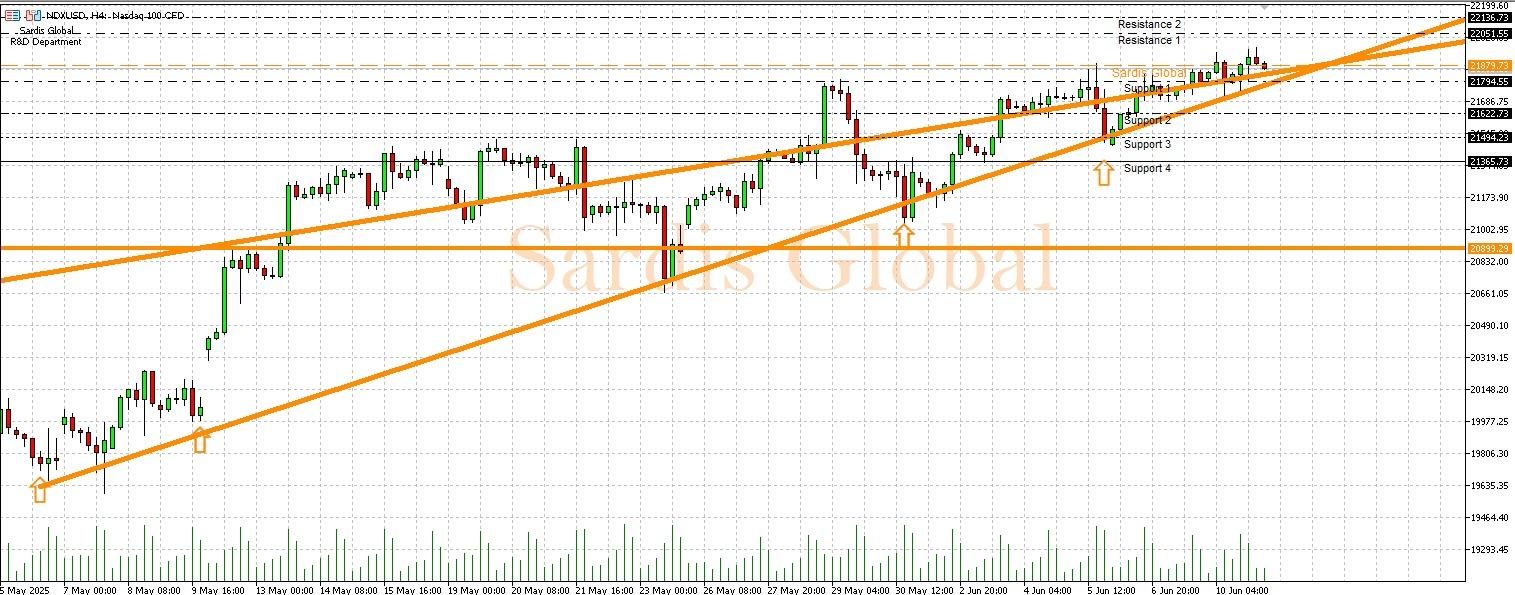

NDXUSD

Today's CPI data is extremely critical for the technology-heavy Nasdaq 100, which is the index most sensitive to interest rates. If inflation exceeds expectations, it would mean that the Fed will maintain its tight stance, directly creating selling pressure on technology stocks. In this negative scenario, levels of 21794.55 (Support 1) and 21622.73 (Support 2) could come into play below the pivot level of 21879.73. A cooling in inflation, on the other hand, could spark strong buying waves for technology stocks by nurturing hopes of interest rate cuts. In this case, 22051.55 (Resistance 1) would be the first target, while with continued buying, 22136.73 (Resistance 2) could be tested.