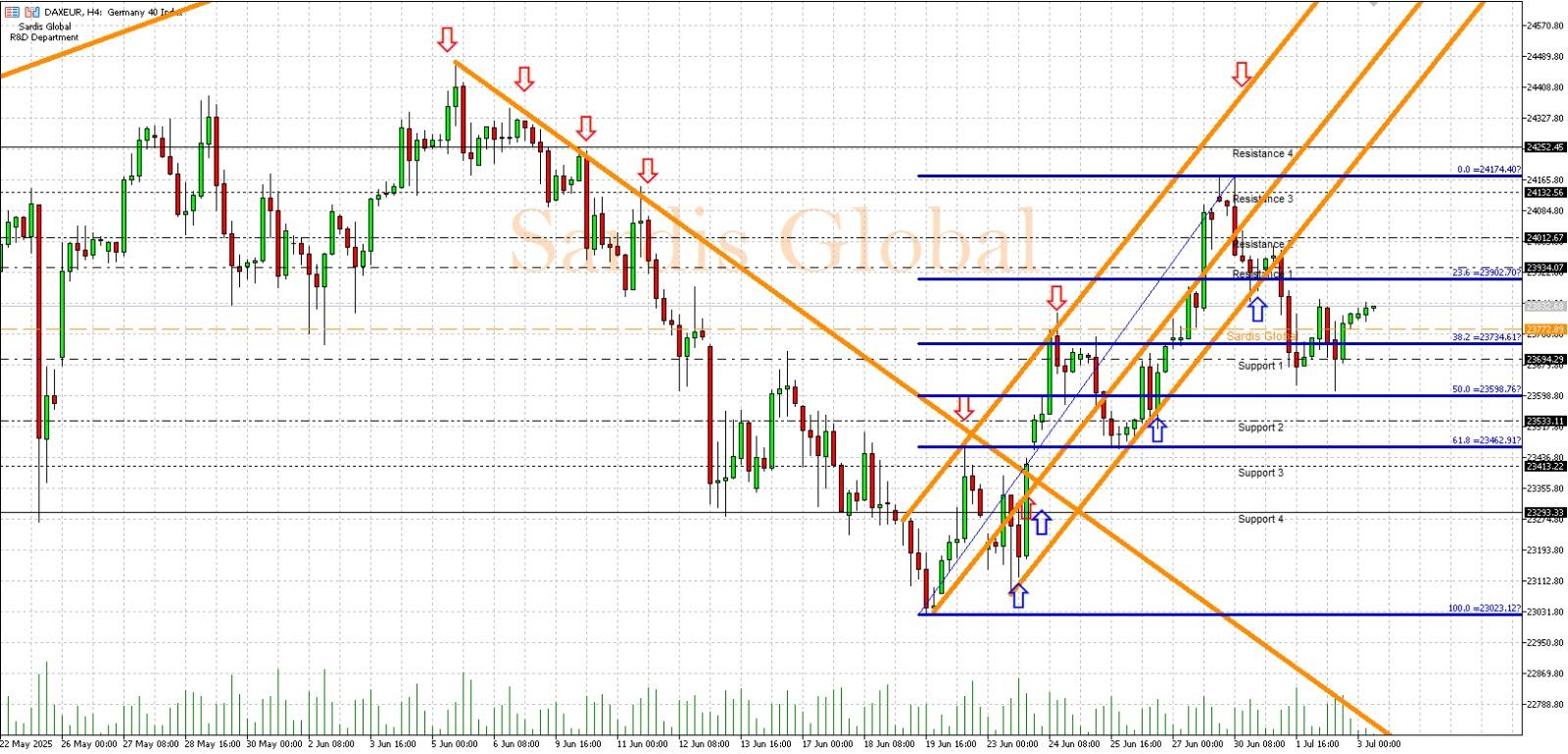

DAXEUR

The German DAX index is trading positively above the pivot level of 23772.91. The double bottom formation on the daily chart has been completed. The Eurozone services PMI data coming in above expectations and the potential interest rate cuts by the ECB are supporting European stock markets. Export-oriented German companies have a high potential to benefit from the weakness of the Euro. Technically, if the resistance at 23990.07 is maintained, the levels of 24019.67 and 24192.55 can be targeted. In the case of downward risks, the levels of 23589.11 and 23419.92 will be monitored below the support at 23634.29.