WTIUSD

Attention in oil prices has turned to the crude oil stock data from the U.S. Energy Information Administration (EIA), which will be announced today. An unexpected drop in stocks could indicate strong demand and support prices upward. However, the FOMC minutes released this evening and the global growth data (PMI, GDP) to be announced later this week may have a more decisive impact on demand expectations than the stock data.

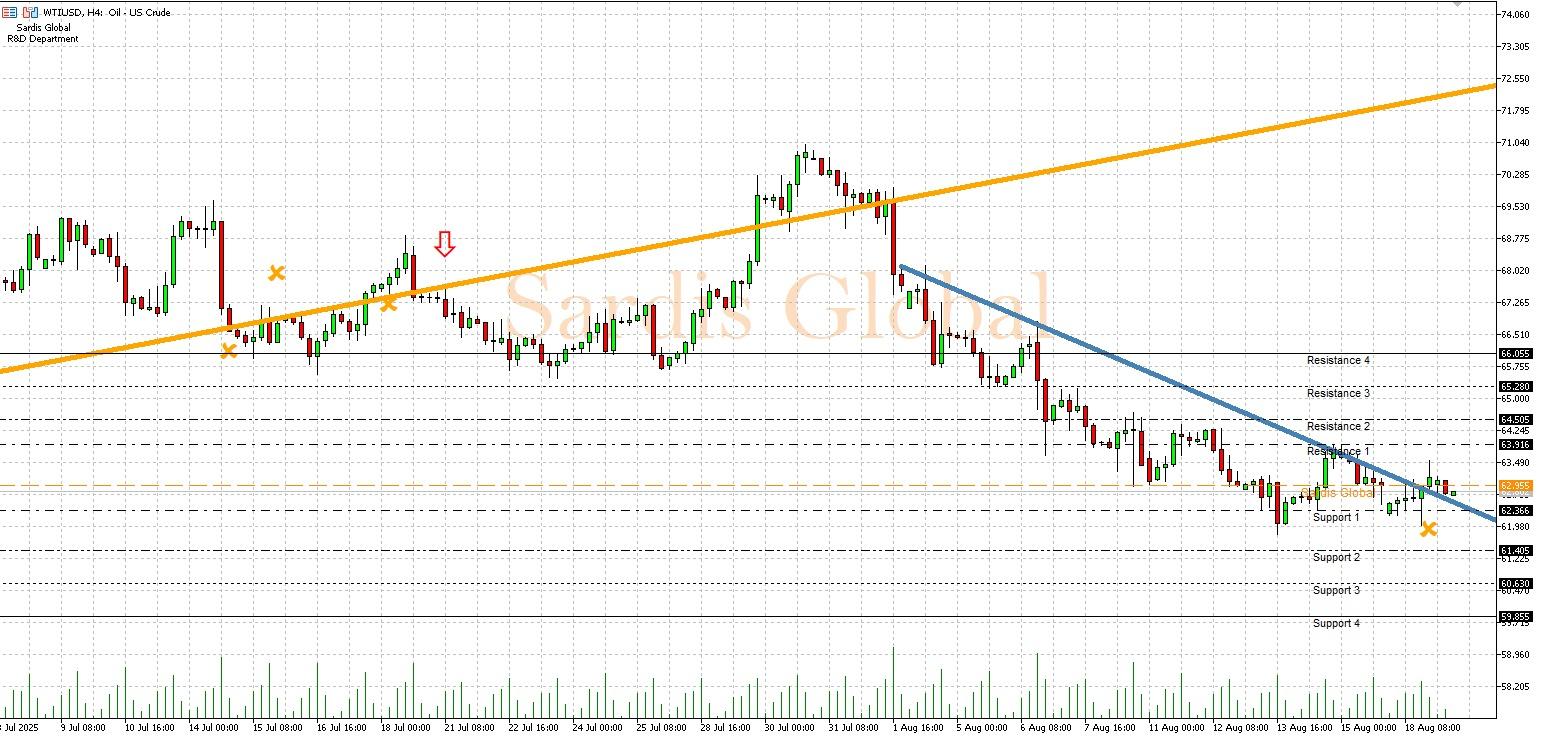

- Technical Levels: 65.280 - 64.505 - 63.916 - 62.955 - 62.366 - 61.405 - 60.630

- Technical Commentary: The 62.955 pivot level maintains its central position. A decrease in stock data could push prices toward the resistance levels of 63.916 and 64.505. Stock figures that exceed expectations or a deterioration in global risk appetite could target the supports at 62.366 and 61.405.