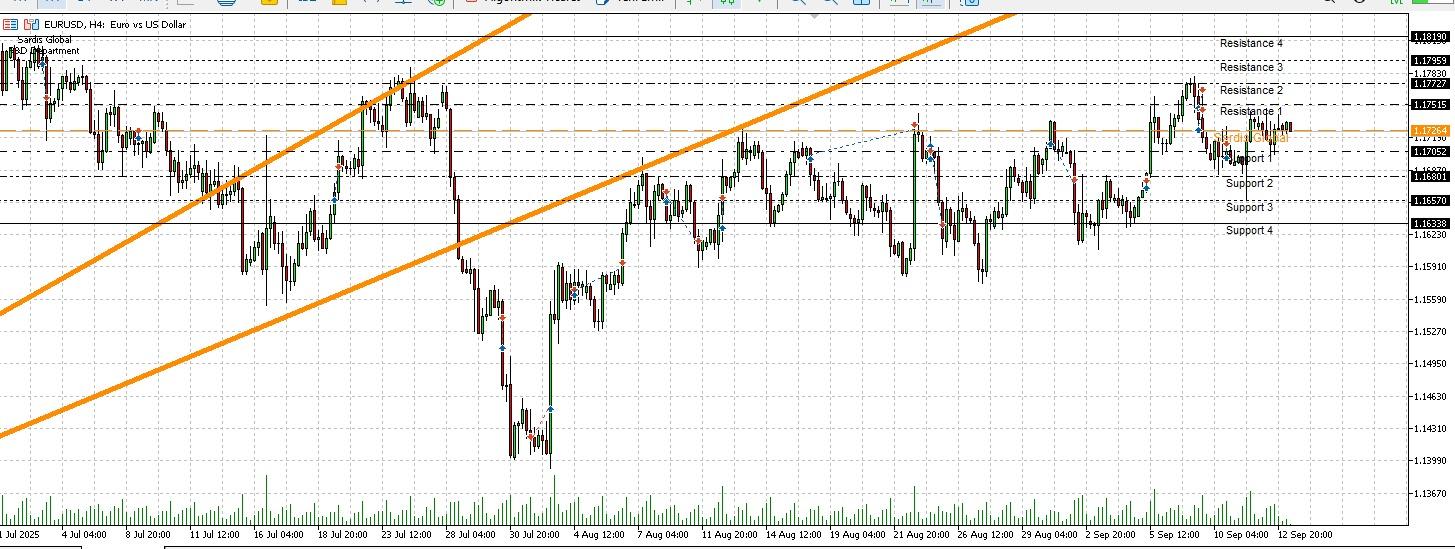

EURUSD

This week, the main direction of the pair will be determined by the FOMC interest rate decision, which will be announced on Wednesday. A 25 basis point cut expected to bring it to 4.25% and then Powell's dovish-toned statements could weaken the Dollar, pushing the pair above the 1.17264 pivot level to the resistance levels of 1.17727 and 1.17959. However, if the US Retail Sales data on Tuesday comes in stronger than expected, there could be pressure on the pair due to the perception that the Fed's hand would be eased. In the case of a hawkish surprise from the Fed (not cutting rates), a sharp decline towards the supports at 1.17052 and 1.16801 is likely. While the Eurozone CPI data expected on Wednesday is anticipated to be in line with expectations, any potential surprise could create additional volatility in the pair.