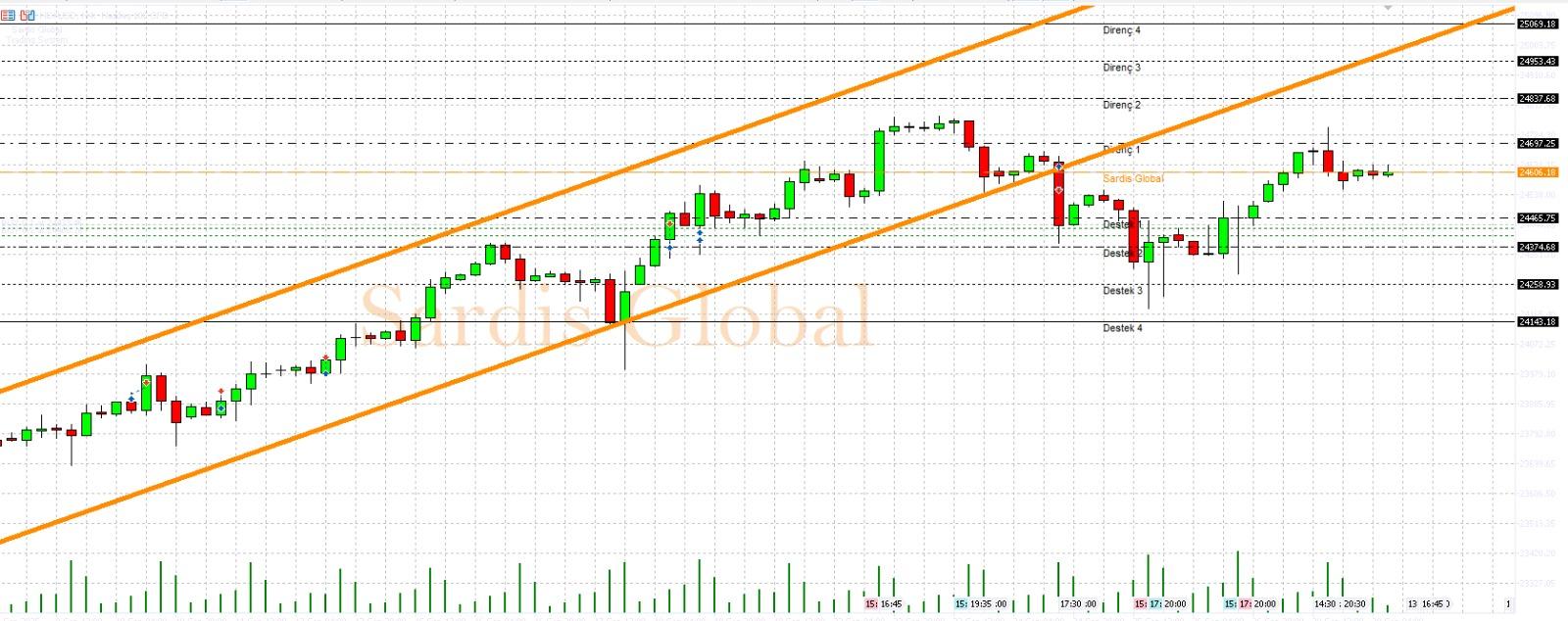

NDXUSD

This week, the index is highly dependent on employment and confidence data that will provide important signals about the health of the U.S. economy. In particular, the Non-Farm Payrolls and Unemployment Rate data to be released on Friday, October 3, will be the main focus of the market. Weaker-than-expected data may raise concerns about the economic slowdown, but it could also strengthen expectations for Fed rate cuts, supporting interest-sensitive sectors such as technology stocks. In this scenario, the levels of 24617 (Resistance 1) and 24681 (Resistance 2) may be targeted. Conversely, strong employment data could maintain "hawkish" Fed expectations, putting pressure on the index and bringing the levels of 24389 (Support 1) and 24225 (Support 2) into focus. U.S. President Trump's speech on Monday evening also has the potential to create volatility in the markets at the beginning of the week.